The Investment Readiness Assessment web portal (e-checker tool) addresses the persistent challenges small and medium-sized enterprises (SMEs) face in securing financing. This innovative, user-friendly digital platform enables SMEs to assess their investment readiness, navigate complex funding ecosystems, and meet the rigorous criteria of programs like the European Innovation Council (EIC) Accelerator.

Designed for early-stage companies and scale-ups, the tool provides personalised feedback, investor-ready summaries, and referrals to specialised funds, advisors, and Technology Transfer Offices (TTOs). The project has already successfully organised a workshop in Paris, Rome, and Poland during its initial phase, and will conduct a workshop for Denmark and Sweden stakeholders to present the assessment process and receive feedback. Subsequently, we will launch and promote the Tool in these markets within 12 months. This project showcases the strategic use of digitalisation to empower SMEs, enhance their competitiveness, and drive sustainable growth across diverse markets.

Implementation

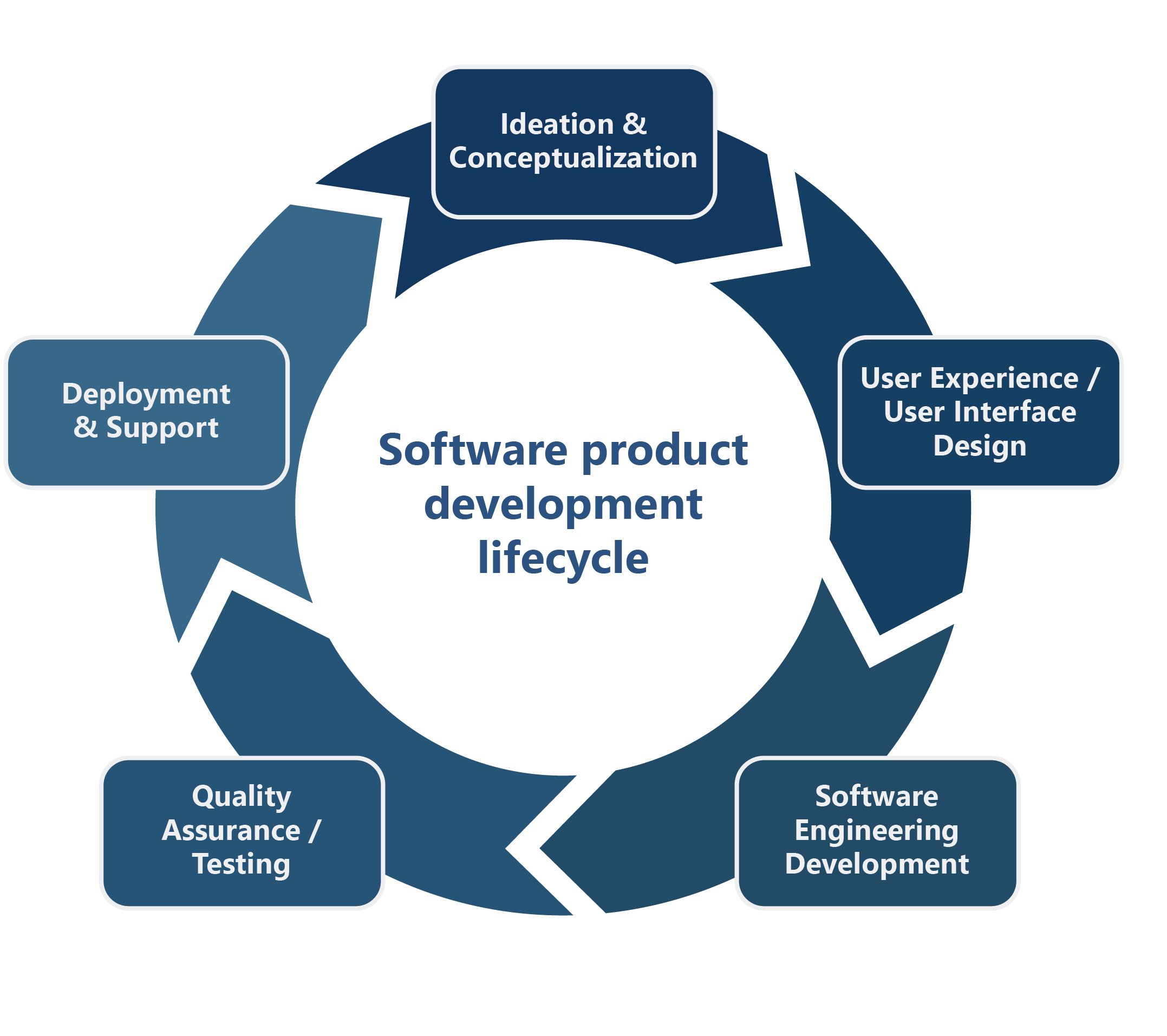

NTU employs its expertise using a phased methodology. The process has begun with exploratory workshops and interviews with diverse stakeholders: SMEs, investors, and advisors. It enabled to gather insights that shape the platform's design and functionalities. This collaborative approach ensures the tool addresses real-world challenges, such as navigating funding ecosystems and meeting investor expectations.

The tool will integrate advanced backend algorithms, an intuitive user interface, and a responsive design, ensuring seamless accessibility across devices. A multi-layered testing framework, including usability testing, and regional workshops guarantees smooth deployment. Stakeholder alignment is reinforced through regular feedback loops and iterative refinements, enhancing the tool’s adaptability to regional funding landscapes. To future-proof the platform, NTU will employ a modular system architecture, enabling scalability and customisation for additional functionalities, languages, and regions. This design will ensure the e-checker tool remains a reliable resource as SMEs evolve.

Impact

NTU’s work addresses the persistent challenges faced by SMEs in accessing funding, fostering their investment readiness, and bridging critical gaps in the financing landscape. By using innovative digital tools, NTU supports economic growth, entrepreneurship, and job creation.

In particular, the following positive impacts can be named:

-

Equipping the SMEs with tailored resources, personalised feedback, and investor-ready summaries, enabling them to navigate funding ecosystems with confidence;

-

Empowering SMEs to secure funding opportunities more effectively by addressing barriers such as asymmetric information and financial constraints;

-

Promoting sustainable growth through the integration of green and innovative finance criteria, contributing to EU resilience and sustainability goals.

-

Strengthening local economies by increased SME competitiveness driving regional development and economic participation across diverse markets.

SDGs

The initiative is supporting the following Sustainable Development Goals (SDGs):